Heard of loan-to-value (LTV) while looking into mortgages or remortgages? If it feels like just another head-scratching financial term, you’re not alone. But fear not… At Meet Margo we’re all about breaking down financial jargon in a simple way to help you take control of your finances.

So, strap in for your crash course. We won’t quiz you at the end. But if you feel like you need some support or info on mortgages, feel free to get in touch with one of our friendly and helpful advisors.

What is LTV?

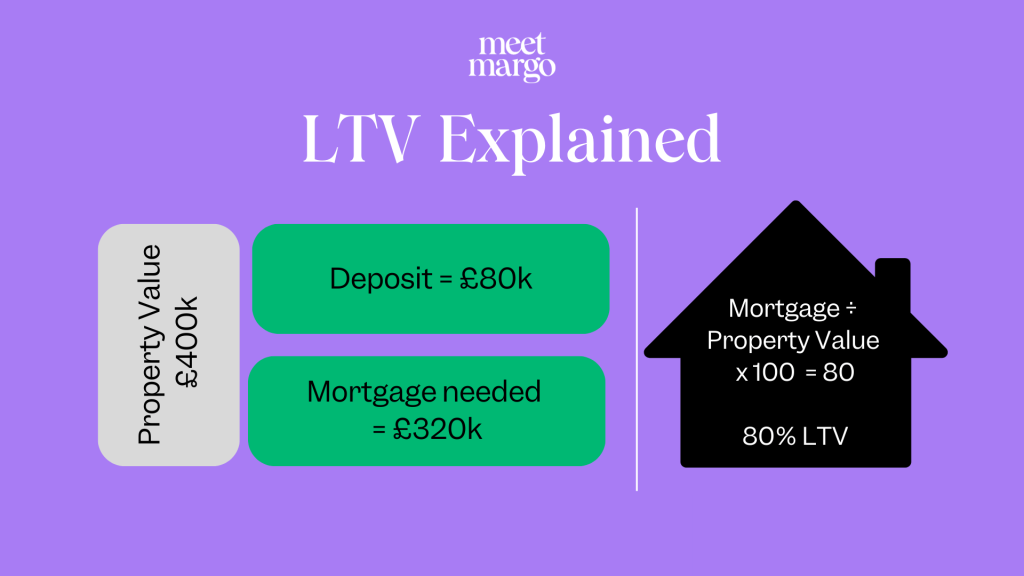

In a nutshell, it’s the ratio between the value of the mortgage and how much the property is worth, expressed as a percentage. It’s calculated by comparing the mortgage loan amount to the value of your home.

Here’s how to calculate loan-to-value

For example, Emily is buying a house worth £400,000, and she has a deposit of £80,000. To buy the house, she’ll need a mortgage of £320,000. So, her LTV is 80%, because £320,000 is 80% of £400,000.

For those who prefer the shorthand calculator version, here’s how it looks:

- Property Value: £400,000

- Deposit: £80,000

- Mortgage needed: £320,000

- 320,000 ÷ 400,000 = 0.8

- 0.8 × 100 = 80% LTV

Why is LTV Important?

Your loan-to-value ratio is a key factor lenders use to determine which mortgage rates are available to you. They view a high LTV ratio as more risky, which usually leads to higher interest rates or the need for mortgage insurance. On the other hand, a low LTV means you’re borrowing less in relation to your property’s value, and lenders are more likely to offer you lower interest rates.

Loan-to-value ratios generally fall into certain ranges, which vary from lender to lender:

- 60% is usually the lowest bracket and offers the best rates.

- 75% is a good LTV and still offers decent rates.

- 80% is where the rates start to climb a little higher.

- 85% to 95% is where you’ll find the highest rates, especially for high LTV mortgages.

Lenders generally reward those with lower LTVs, meaning if you can save up a bigger deposit (or if your property has increased in value), you may be able to secure a much better mortgage deal.

What happens when your loan-to-value changes?

When you’re due for a mortgage renewal, your LTV ratio might change. If your property’s value has increased and you’ve made regular mortgage payments, your LTV ratio will have gone down. This is great news because it means you have more equity in your home, and with a lower LTV, you can access better mortgage deals with lower interest rates. What’s not to love?

How to lower your loan-to-value and access better mortgage rates

Whether you’re a first-time buyer or you’re remortgaging, there are some things you can do to lower your LTV and access better rates:

- Save a bigger deposit: The larger your deposit, the lower your LTV.

- Add value to your property: Home improvements can increase your property’s value, which in turn reduces your LTV.

- Overpay on your mortgage: Making extra payments can reduce your mortgage balance, improving your LTV.

The bottom line is: the lower your LTV, the better your options for mortgage deals, including potentially lower interest rates and smaller monthly payments.

As you explore your options, make sure to use a mortgage calculator to see how your loan amount, LTV, and interest rates affect your monthly payments.

We hope, with these tips, you’ll be well on your way to securing the best deal based on your LTV, but we’re always here if you need any support.

Here at Meet Margo, we’re all about sharing helpful info and insights on all things mortgages and finance. But just a heads up, our blog isn’t regulated by the Financial Conduct Authority and is for general information only and—it’s not intended as financial advice. For the nitty-gritty financial stuff, it’s always best to speak to an expert.