Let’s face it—buying a home is hard for everyone right now. But for women, the odds are stacked even higher. Gender Housing Gap ENTERS CHAT

While the gender pay gap often makes headlines, its lesser known sibling, the gender housing gap, has flown quietly under the radar. Its impacts, however, are loud and far-reaching, meaning women face unique barriers when it comes to saving for and buying their homes. Research by Women’s Budget Group (WBG), has found there’s not one area in England which could be considered affordable for a single woman to rent or buy a home.

It all sounds a bit bleak doesn’t it? So, here’s the good news: while these challenges are very real, there are things we can do to make a difference.

At Meet Margo, we’re passionate about empowering women tackle financial obstacles head-on and make confident, informed decisions.

We believe knowledge is power, and in this article we’ll run through:

- What is the gender housing gap

- What’s holding many women back from owning a home

- How we’re helping more women achieve their homeownership goals

What is the gender housing gap?

In simple terms, the gender housing gap is the difference in housing outcomes between women and men. It covers everything from affordability and ownership to safety and overcrowding. A higher proportion of women consistently face more hurdles in achieving homeownership, largely due to inequalities that trickle into every corner of life.

But what does this actually look like? Let’s break it down.

The challenges holding women back from homeownership

It’s not just one issue that’s making it harder for women to get onto the housing ladder—it’s a mix of economic, social, and systemic factors.

1. The cost of living crunch means a deposit gap

We know that on average, women earn 11.3% less than men in the UK. This pay disparity can impact how much women can borrow when it’s time to apply for a mortgage. It also directly affects how much they can save, taking 5.3 years longer than men to save enough to buy their first home (iPlace Global, 2023).

Moneybox’s Voice of FTB 2024 report highlights the ripple effects of the pay gap loud and clear:

- Millennial women save £7,400 less on average for a house deposit than their male counterparts.

- 44% of women have cut back on deposit savings due to financial pressures, compared to just 33% of men.

- Women are also delaying life milestones, with 30% postponing starting a family to focus on saving for a home (compared to 24% of men).

2. Unaffordable homes

Here’s the stark reality: nationally, house prices are 11 times women’s salaries, compared to 8 times men’s. And in London, the gap is even more staggering: 16 times for women versus 13 times for men.

Additionally, The Women’s Budget Group reports that there’s not a single area in England where a single woman earning the average salary can afford to rent or buy. It’s a hard pill to swallow, but it highlights just how critical this issue is.

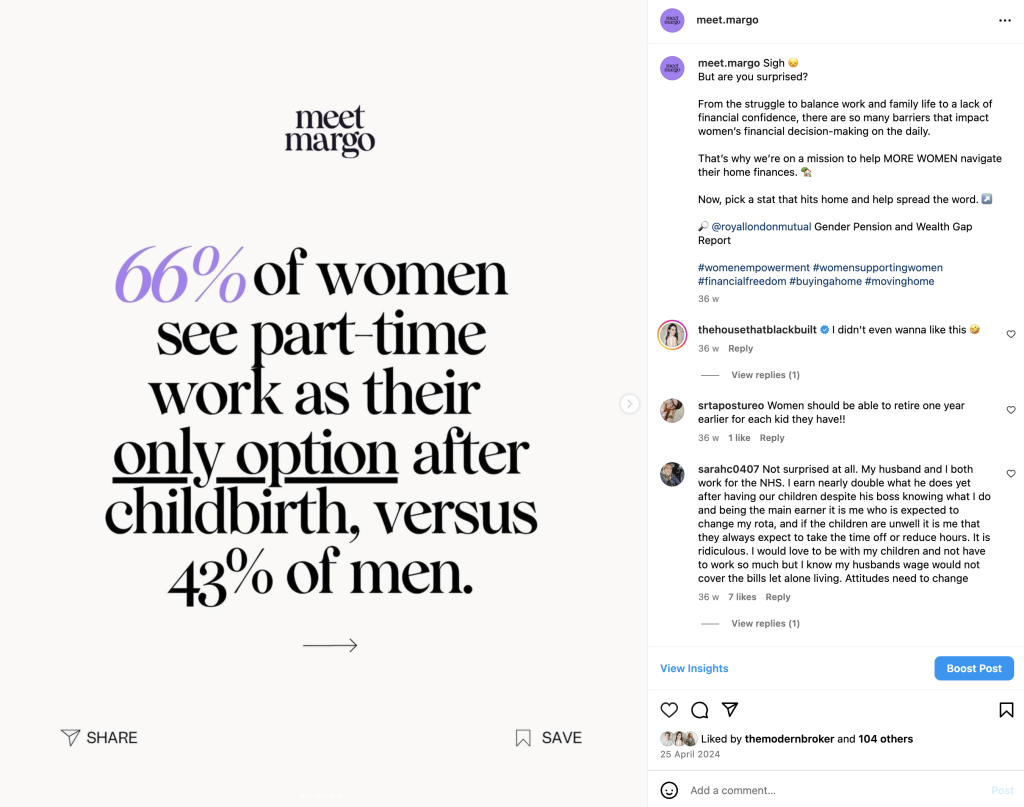

3. Career interruptions create long-term barriers to homeownership

Many women take career breaks or work part-time to care for children or aging relatives, which often comes at a financial cost. Lower lifetime earnings, reduced borrowing power, and fewer opportunities to build equity all contribute to making homeownership harder for women.

4. The Confidence Gap

There’s also a psychological side to the gender housing gap. Research shows that women are less confident when it comes to managing their money, particularly when it involves saving or investing.

According to HSBC UK:

- 69% of women don’t feel confident about investing.

- Over a third have no savings at all.

This confidence gap can prevent women from taking steps to improve their financial situations, like exploring investment opportunities or negotiating better deals.

5. Life transitions like divorce add complexity

Women are likely to see their annual household income take a serious financial hit in the first year following their divorce, falling by an estimated 41%, compared to just 21% for men, according to research from Legal & General Retail. This gap is largely due to lower lifetime earnings, career interruptions, and fewer savings, creating serious hurdles in the post-divorce homeownership journey.

Closing the gender housing gap

At Meet Margo, we know the gender housing gap is a real issue, and it’s one we’re determined to tackle.

“Homeownership should be achievable for everyone, no matter their gender. But that’s not always the case, particularly for women” says Meet Margo Founder Claire Towe.

“Our Meet Margo journey began with listening to the challenges women face when it comes to navigating the property ladder. From confusion and struggles to fears about managing home finances, we knew that tailored, accessible support was necessary but somewhat lacking.

“And that’s where we come in. By making mortgage advice accessible, we empower women to make confident, informed decisions about their homes, achieve their homeownership goals and ultimately, work towards closing the gender housing gap.”

Here’s how we’re making it happen.

We’re a fee-free mortgage broker

We believe financial barriers should never stand in the way of good advice. Unlike traditional brokers, we offer free mortgage guidance, taking away the upfront cost of getting expert help.

Tailored financial advice

Women’s financial journeys are often different from men’s. Whether it’s dealing with pay gaps, career breaks, or life transitions like parenthood or retirement, we provide advice that’s tailored to women’s specific needs.

Get advice at your fingertips with our mortgage app

Our Meet Margo Mortgage Adviser app is designed to simplify the mortgage process, starting with remortgages. Launched in June 2024, the app has already been downloaded over 4,000 times, showing just how much people need straightforward, no-nonsense advice on mortgages. It provides guided journeys, direct access to advisers, and an easy way to manage home finance—all free of charge.

Spreading the word

We believe that knowledge is key to overcoming the gender housing gap. By partnering with like-minded companies such as Female Invest, AJ Bell’s Money Matters and Stowe Family Law to name a few, we’re committed to spreading awareness and providing the tools women need to take control of their homeownership journey.

Empowering women on the path to homeownership

The Gender Housing Gap is a real barrier for many women, making their journey to homeownership more challenging.

At Meet Margo, we’re here to help every step of the way. Whether you’re saving for your first home, navigating a remortgage, or simply looking for advice on your mortgage options, we’ve got your back.

Ready to remortgage? Download our app – it’s the fastest way to connect with our advisers.

For everything else, whether you’re buying your first property, moving home, looking for insurance, or interested in partnering with us, fill out the form on our contact page, and one of our mortgage advisors will be in touch.