💡 The gender pay gap isn’t a myth — it’s a real-world issue that impacts women’s ability to save, borrow, and build financial security. In 2024, after two years of narrowing, the UK’s gender pay gap widened again.

According to the Global Payroll Association (GPA), the average hourly salary for men rose to £23.11, while for women, it stood at £19.92 — a gap of 13.8. That’s equivalent to women earning around 86p for every pound earned by men. The disparity is even more pronounced in areas like London, where the pay gap reached 18.8.

But how does this inequality affect women’s chances of homeownership? And what can women do to take control of their finances despite these challenges?

The Financial Impact of the Gender Pay Gap

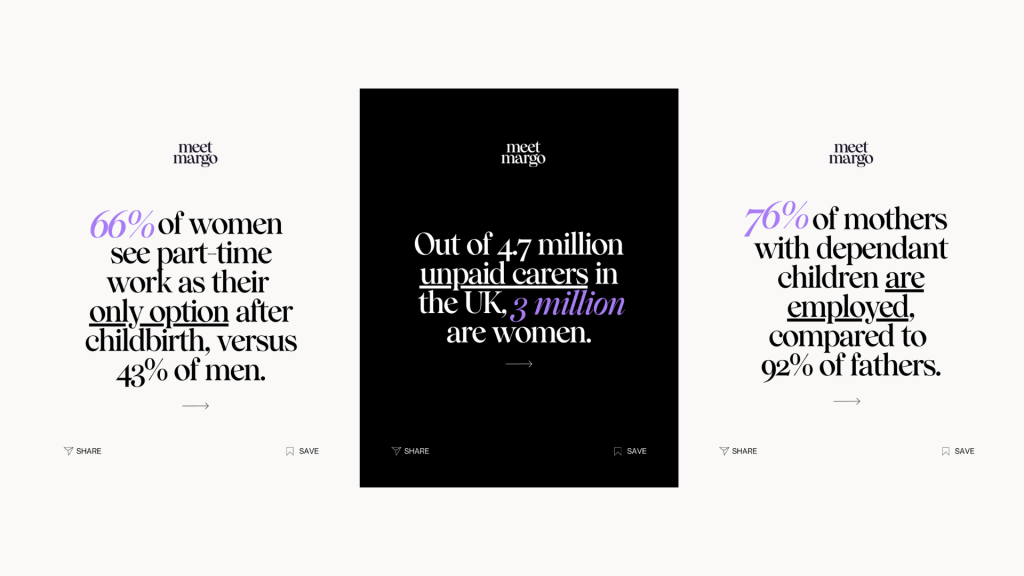

Here’s the thing—the pay gap isn’t just about who gets paid what. It exists because of deeper challenges like the types of jobs women do, the increased chances of them taking career breaks, and the lack of flexible work options. All of these factors can have a major impact on our ability to get on or move up the housing ladder. This is what’s known as the Gender Housing Gap and here’s how it can play out:

Lower Savings Potential

With less money coming in, women have less capacity to save for a house deposit. This disparity results in women taking approximately 5.3 years longer than men to save enough to buy their first home (iPlace Global, 2023).

Reduced Borrowing Power

The income gap limits women’s borrowing capacity, as mortgage lenders base their offers on income levels. Nationally, house prices are 11 times women’s salaries, compared to 8 times men’s, making it more challenging for women to secure adequate mortgage amounts.

Increased Financial Vulnerability

Career breaks for childcare or eldercare often result in reduced lifetime earnings for women. Additionally, women are more likely to delay life milestones, with 30% postponing starting a family to focus on saving for a home, compared to 24% of men.

Longer Timeframes

Due to lower earnings, women may need more time to save the same amount as their male counterparts, delaying their entry into the housing market. A recent report claimed millennial women save £7,400 less on average for a house deposit than their male counterparts.

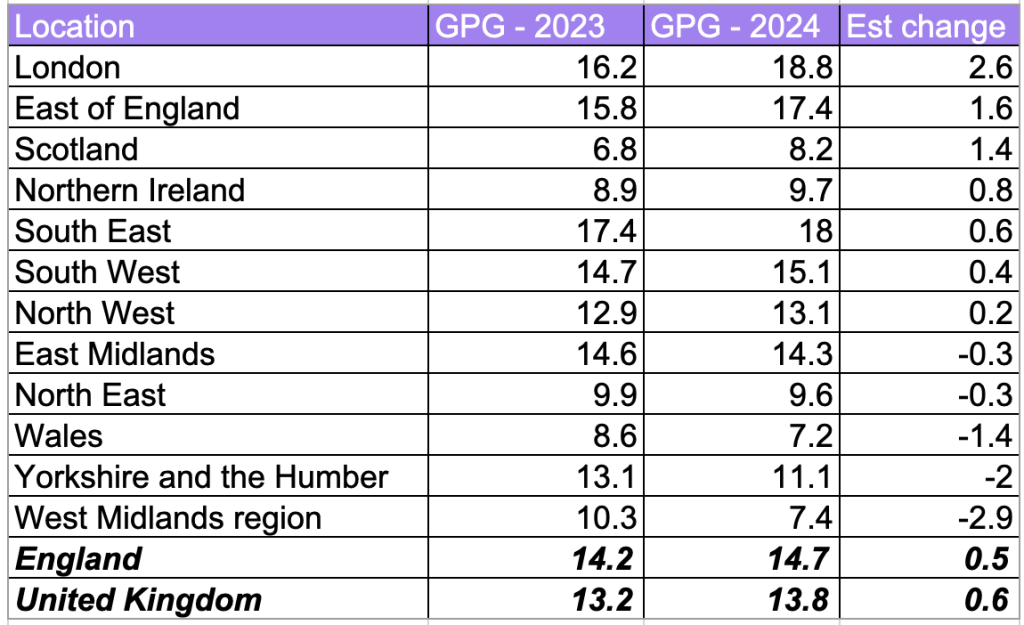

Regional Breakdown of the Gender Pay Gap

The gender pay gap isn’t uniform across the UK. In some regions, the disparity is far greater than the national average of 13.8. For instance, London (no surprises) has the biggest gap at 18.8, with Wales the smallest gap at 7.2.

Understanding the gap in your area can help you assess how it might impact your financial goals.

Steps to Take Control of Your Financial Future

Tackling the gender pay gap is a big, long-term job. Fixing it isn’t just about better pay; it’s about changing policies, and workplace culture, and improving financial education to empower more women. This won’t happen overnight, but there are things women can do now to boost their financial resilience when it comes to owning a home:

1. Know Your Numbers

Start by understanding your financial position. How much can you realistically save each month? Use online calculators to estimate how much you’ll need for a deposit and factor in other costs like stamp duty and legal fees. The same applies if moving up the ladder.

2. Explore Government Schemes

If you’re a first-time buyer, there are several schemes that can help you get onto the property ladder. Shared ownership scheme allows you to buy a share of a property, making it more affordable. The Lifetime ISA lets you save up to £4,000 a year with a 25% government bonus, up to £1,000 annually. The Mortgage Guarantee Scheme helps you secure a mortgage with just a 5% deposit, available until June 2025.

3. Seek Expert Advice

Mortgage lending criteria can vary significantly between lenders, which is why it’s so important to have an expert on your side. What might not work with one lender could be a perfect fit with another.

A good mortgage adviser, like Meet Margo, can make a world of difference when it comes to navigating the complex world of homeownership. We’ll help you find mortgage products that are tailored specifically to your financial situation, ensuring that you’re not only getting the best possible deal but also making the most of your borrowing power.

Why It Matters?

The gender pay gap isn’t just a statistic—it’s a challenge that affects women’s financial futures in real and lasting ways. While systemic change takes time, understanding the factors behind the gap and taking proactive steps can make a difference.

Whether it’s making informed financial decisions, exploring available support schemes, or seeking expert advice, every step counts toward greater financial resilience.

At Meet Margo, we’re here to help every step of the way. Whether you’re saving for your first home, navigating a remortgage, or simply looking for advice on your mortgage options, we’ve got your back.

Ready to remortgage? Download our app – it’s the fastest way to connect with our advisers.

For everything else, whether you’re buying your first property, moving home, looking for insurance, or interested in partnering with us, fill out the form on our contact page, and one of our mortgage advisors will be in touch.

If you stop paying your mortgage, you could lose your home.